Much discussion has surrounded the question of whether a growth-oriented or a value-oriented U.S. equity portfolio is best for the long-term investment portfolio. Specifically, is one of the two dominant styles the “best for the long-term” that provides higher risk-adjusted returns while reducing market drawdowns, thereby allowing the trustee, investment committee or consultant to “set-it-and forget-it”?

It is generally accepted that there are periods when a growth equity portfolio will outperform most equity benchmarks and most value strategies, while at other times a value-oriented portfolio will outperform those same benchmarks and a growth-weighted portfolio. Often, this style cycle domination will last for extended periods (years) of time.

Many active equity managers, market strategists, allocators, and index fund providers, would prefer to have an investment committee overlook the cyclicality of styles within the U.S. equity market and focus on a generally easier and understandable single equity benchmark and/or a passive allocation approach to investing, such as broad-based equity index portfolios or a barbell growth/value allocation structure, to achieve an “average” benchmark performance over full market cycles. This is particularly true, given most investment managers, consultants, allocators, and investment committees do not have a solid and proven equity allocation methodology in their arsenal of services.

We recognize that a semi-passive or passive approach is easier, cheaper, and less controversial than striving to generate HIGHER, RISK-ADJUSTED equity returns, with the intent of increasing LONGER-TERM equity portfolio stability over full market cycles.

Unfortunately, our experience has also shown this passive mindset typically lasts until there is a significant market upheaval, an extended shift in style preferences [value to growth or growth to value], or a wholesale decline in the equity markets. This causes investment committees and trustees to “throw in the towel”, leading to either ignoring the decline and its long-term consequences while believing “the markets always come back”, or making unwise and expensive knee-jerk tactical changes, raising cash, terminating managers, consultants, and strategies in the hopes of stabilizing the investment structure.

Investment committees and their advisors, strategists, and analysts can and should recognize and respond to these STRATEGIC cyclical equity style shifts, while maintaining a FULLY INVESTED PORTFOLIO i.e., no market timing. Incorporating a strategic equity styled strategy plan can be inexpensive, while often including much of the current and existing style adherent investment components prevalent in the equity portfolio, in particular, active style adherent investment managers and funds.

Since January of 1993 to present [according to the Enhanced Dynamic® methodology] there have been 4 cycles of value outperforming growth, and 4 cycles of growth outperforming value (including the current growth cycle). The duration of the cycles lasted as short as 24 months (4-1-2016 to 3-31-18) and as long as 63 months (7-1-2000 to 9-30-2005).

Verification and validation studies conducted by the University of Chicago, Graduate School of Business, Center in Research in Security Pricing, and the University of Chicago, Master of Science Program in Financial Mathematics (in 4 separate studies conducted in 2000, 2002, 2016, and 2018), have confirmed this style cyclicality and the significant risk-adjusted benefits to be derived from the strategic weighting and reallocation of domestic equity portfolios.

It is important to emphasize the results achieved with a style-oriented (growth to value) reallocation methodology should not entail tactical trading or shifting, nor market timing, as typically these strategies are short-term and inappropriate for prudent investment practices and institutional portfolio management.

We believe the use of independent, style adherent, active domestic equity managers are particularly beneficial. We have found that in-favor active equity managers deliver superior risk-adjusted investment returns versus their index benchmarks, peers, and indices, due to their ability to dynamically shift weightings and tilt portfolios to take advantage of the internal sector momentums of their style category.

We have also found that many active equity managers offering a blended equity strategy, balanced or broad market strategy (growth + value), typically do not provide superior or consistent performance due to this “style bleed”, when compared to specialized manager allocations based upon style allocations. This implies a disconnect in the research and security selection of growth managers versus value managers, and the all-important strategic allocations between styles on a consistent, research-proven methodology.

Finally, time and market cycles have proven that a regimented index allocation strategy, such as the S&P 500, delivers, at best, a less expensive but “average” market return that does not allow for above-average returns or downside protections as dynamically shifting sectors and securities with active managers will typically provide. This is due to the general inability to take advantage of market momentums within a specific style, such as tilting a growth portfolio from technology to bio-medical or information tech, for which an active style adherent equity manager will provide.

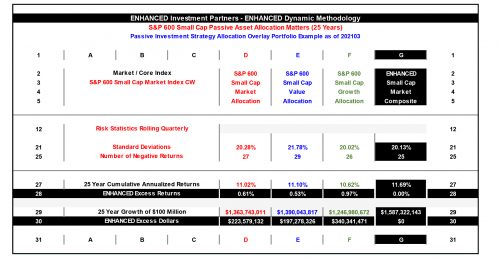

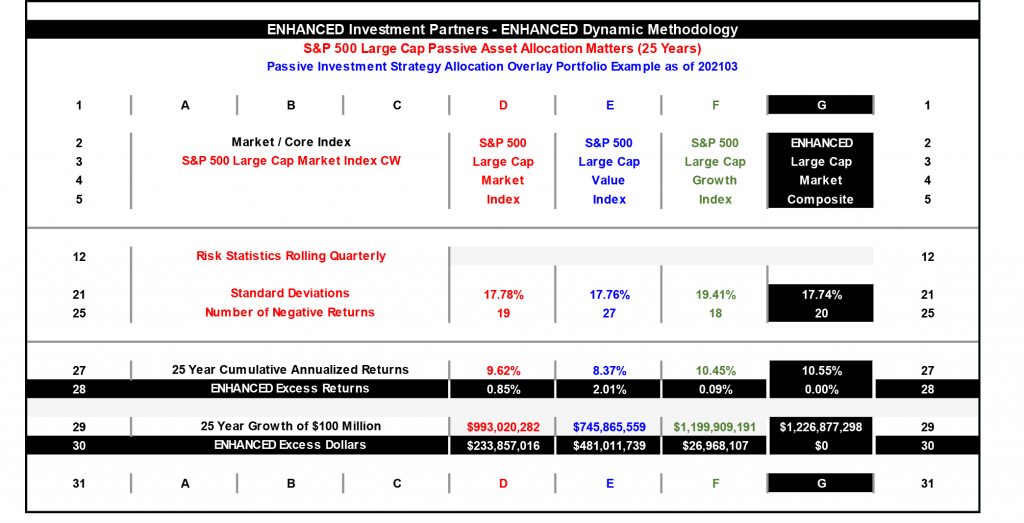

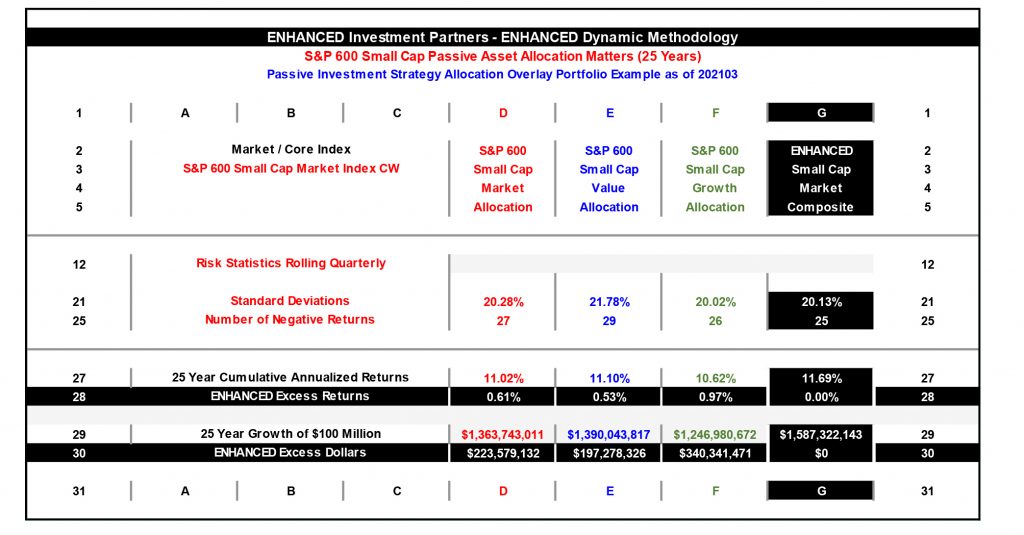

We are not suggesting an “all in” approach to style investing, i.e., all growth or all value. We have found maintaining a static 25% allocation to both growth and value allocations, and strategically tilting 50% of the allocation to the “in-favor” strategy, accomplishes the following with both Large Capitalization and Small Capitalization index investment vehicles:

Note: the above study utilizes passive (S&P 500) index returns. As discussed herein, the Enhanced Dynamic® strategy has proven that active, style adherent equity managers will generate consistently higher risk-adjusted returns, and generally lower downside risk, then those generated through index strategies, net of all fees and expenses.

We recognize there are many qualitatively and quantitively based factor investment models that offer direction to style-oriented equity allocation strategies for active, semi-active and passive investing. How sound and proven are their merits in the long-term investment process is not for us to comment.

The Enhanced Dynamic® methodology was developed to deliver independent, unbiased investment guidance without the potential conflicts and biases present with most “in-house” fund companies, investment consultants, CIOs, and investment management service providers such as trust companies and banks.

Enhanced Dynamic® is a strategic equity allocation methodology that was developed seeking to produce higher domestic equity portfolio returns and reduce portfolio volatility while maintaining a fully invested equity portfolio. Our domestic equity allocation process employs a methodology that seeks to identify the current dominant equity style and cap size, as well as the out-of-favor (less productive) style and cap size. Based upon this identification, portfolios are strategically tilted to the most productive asset class, while the out-of-favor style and cap size asset class is de-emphasized. Equity portfolios are expected to be fully invested at all times. This is not a tactical market timing program.

Investment style dominance has typically prevailed across all capitalization sizes.

- Since 1978 versus the S&P 500, the Enhanced Dynamic® domestic equity investment methodology has achieved statistically significant annualized excess returns, adjusted for volatility, with retirement plan consulting relationships, empirical (back tested) and academic studies using the Wilshire large and small cap indexes.

- In fact, since 1978, as shown through every empirical academic study and our own internal full market cycle studies, the Enhanced Dynamic® methodology has consistently delivered higher risk-adjusted results through all investment cycles with indexes, with the final results increasing considerably when independent active, style adherent domestic equity managers were included net, net of fees and expenses.

Additional information regarding the applications of our Enhanced Dynamic® methodology for investment portfolios and our investment funds may be found at www.enhancedinvesting.com, www.enhanceddynamic.com, and www.enhancedhedge.com, or by contacting the writers directly:

Robert B Rowe Jr.

Managing Partner

rbr@enhancedinvesting.com

312-913-9872

Ivory Day Jr.

CCO Chief Investment Officer

iday@enhancedinvesting.com

312-848-4867